31+ how to drop mortgage insurance

Web You may have enough home equity that you qualify to have your private mortgage insurance cancelled. Get to where you only owe 80 of your homes value.

How To Get Rid Of Pmi Removing Private Mortgage Insurance

Have to get a home value assessment through Wells Fargo at your own expense to confirm your homes value hasnt declined.

. How Much Interest Can You Save By Increasing Your Mortgage Payment. You will need to request in writing your lender cancel your PMI. Web One way to get rid of mortgage insurance is just to keep paying off your loan until you have achieved the minimum required equity or LTV ratio to do so.

It lowers the investors risk when funding a home loan. Web If youre requesting to have PMI removed you. Web The good news is that there are steps you can take to remove your monthly mortgage insurance payments.

Web How Refinancing FHA Loans Can Remove Mortgage Insurance One option to remove mortgage insurance is to refinance an FHA loan into a new loan. In most cases if you. Dropping MIP from FHA Loans If you make a 10.

The good news is that there are no restrictions on refinancing out of FHA. If you cant find the disclosure form contact your servicer. If your loan has met certain conditions.

Pay down your mortgage. Mortgage insurance protects the investor or noteholder if the borrower defaults on the loan. Web This date should have been given to you in writing on a PMI disclosure form when you received your mortgage.

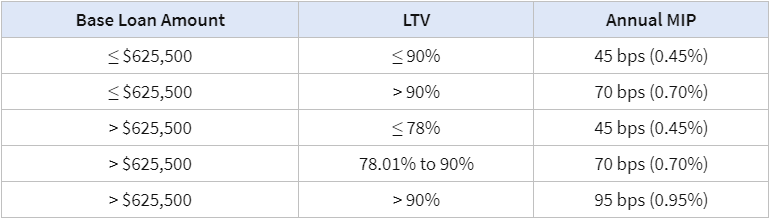

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Web To stop paying mortgage insurance premiums youd need to refinance out of your FHA loan. Web The average cost of private mortgage insurance or PMI for a conventional home loan ranges from 058 to 186 of the original loan amount per year according to the Urban.

Web Speak with a loan officer at the bank servicing your mortgage about your options to drop mortgage insurance. Web If youre looking to ditch your monthly PMI payments here are a few options. Web Like private lenders the FHA requires you take out mortgage insurance.

With a 15-year fixed-rate FHA mortgage you can drop insurance as soon as your mortgage loan. With the FHA loan youll have to pay mortgage. Ask to cancel your PMI.

Web The type of mortgage loan you take out will also have a significant impact on your mortgage insurance.

Village Post August 2022 By Post City Magazines Issuu

How To Get Rid Of Pmi Nerdwallet

Understanding Mortgage Insurance Home Loans

5 Types Of Private Mortgage Insurance Pmi

How To Get Rid Of Pmi A Practical Guide To Removing Private Mortgage Insurance Neighbor Blog

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/DVENROHZ2ZBDNMEWM5JET5YCLA.jpg)

How To Get Rid Of Pmi The Dough Roller

How To Get Rid Of Pmi A Practical Guide To Removing Private Mortgage Insurance Neighbor Blog

How To Dump Pmi Asap Fox Business

How To Get Rid Of Pmi Nerdwallet

4 Ways To Ditch Pmi Lower Your House Payment Finder Com

How To Remove Pmi On A Conventional Loan 2022 Private Mortgage Insurance Youtube

How To Get Rid Of Pmi Mortgages And Advice U S News

How To Get Rid Of Pmi 2023 Consumeraffairs

How To Get Rid Of Private Mortgage Insurance Pmi Lendingtree

How To Get Rid Of Pmi Removing Private Mortgage Insurance

![]()

Mortgage Brokers South Sydney Located In Rockdale Mortgage Choice

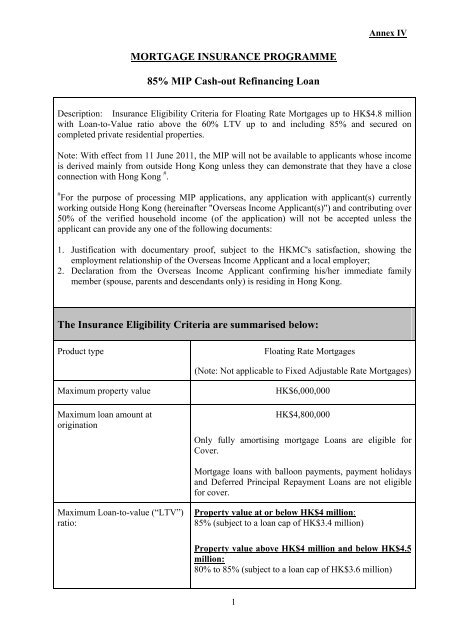

Mortgage Insurance Programme 85 Mip Cash Out